It is important to note here that clause a and b of Section 175 were substituted for clauses a aa ab and b by CGST. In this article we will discuss the concept of Blocked Credit and understand the cases where ITC can not be taken under GST.

Important Points Of Input Tax Credit In Gst Input Tax Credit In Gst

5One can credit the Input Tax Credit in his Electronic Credit Ledger in a provisional manner on the common portal as prescribed in model GST law.

. For personal consumption goods or services or both are consumed in blocked input tax credit. 123422019 GST dated 11 November 2019 allows 120 input credit of invoices uploaded by the suppliers. The most common input-taxed sales are financial supplies such as lending money or the provision of credit for a fee and selling or renting out residential premises.

This page is also available in. List of articles related to Input Tax Credit category are listed here. Melayu Malay 简体中文 Chinese Simplified Malaysia GST Blocked Input Tax Credit.

ITC Reversal for payment after 180 days. This is how the whole chain of the Input Tax Credit under GST functions. ITEMS ON WHICH CREDIT IS NOT ALLOWED IN GST.

Input Tax Credit means the tax paid by the Registered Recipient of goods or services in the form of Central Tax CGST State Tax SGST or Union Territory Tax UTGST Integrated Tax IGST. According to section 17 5 of CGST Act Input Tax Credit shall not be available in the following cases. Goods and Service tax Input credit is available to taxpayers.

The goods or services are supplied to you or imported by you. Such tax is charged by the Registered Supplier at the time of sale of goods. The credit can be blocked which is ineligible or availed fraudulently as per the belief of commissioner.

For more information please refer to the Guide on Agriculture. Input tax is defined as the GST incurred on any purchase or acquisition of goods and services by a taxable person for making a taxable supply in the course or furtherance of business. Apportionment of credit Section 17.

List of Ineligible Items on which ITC is not allowed under GST Laws - Updated as on 8th September 2020. A Motor Vehicles for transportation of persons having approved seating capacity of 13 persons or less. ITC Reversal in case of insurance claim.

1 Where the goods or services or both are used by the registered person partly for the purpose of any business and partly for other purposes the amount of credit shall be restricted to so much of the input tax as is attributable to the purposes of his business. Though one of the pillars of GST is a free flow of credits in order to eliminate cascading of taxes the input tax credit is not available in respect of the certain inward supply of goods or services as per Section 175 of the CGST Act2017. Any tax is paid under sections 74 129 and 130 of the Internal Revenue Code often fraud instances.

This happens because Ajay Bhai had already paid a GST of Rs18 000 on his input hence he can claim an Input Tax Credit of Rs18000. ITEMS ON WHICH CREDIT NOT ALLOWED IN GST. These are called blocked credit.

Common ITC Reversal in GST. When purchasing from GST-registered suppliers or importing goods into Singapore you may have incurred GST input tax. Definitions of ITC Input Tax Credit few terms used.

The goods or services are used or will be used for the purpose of your business. You cannot claim utilize the credits on these specified cases services an example would be the purchase of goods services for personal use. The GST law has specific cases where no Input Tax Credit or ITC can be claimed or is available to the taxpayer.

Blocked credits under GST are the tax that cannot be claimed even after paying a. You can claim the input tax incurred when you satisfy all of the conditions for making such a claim. 2 Where the goods or services or.

You should only claim input tax in the accounting period corresponding to the date of the invoice or import permit. ITC Reversal for Credit Notes reflected in GSTR-2A. 2 Where the goods or services or.

Matching of claimed ITC GSTR-2AB vs GSTR-3B. The GST section 175 describes the circumstances when such block credit s are ineligible and the special conditions when they become eligible to avail ITCs. 752019 dated 26122019 Government inserted new Rule 86A in CGST Rules 2017 with effect from 26122019 to put restrictions or conditions on use of Input Tax Credit amount available in Electronic Credit Ledger.

It seems that when government allows input credit to recipient only when suppliers uploads their invoices in the GST return it seems sr. You can claim input tax incurred on your purchases only if all the following conditions are met. GST Tran-1 and Tran-2 Issues.

Input-taxed sales are sales of goods and services that dont include GST in the price. GST GUIDE FOR INPUT TAX CREDIT 250413 3 Flat Rate Addition 5. You cant claim GST credits for the GST included in the price of your inputs.

As per section 17 5 of CGST Act 2017 there is an entire class of cases goods services for which the ITC remains blocked such Input Tax Credit is called ineligible or blocked credits under GST. Apportionment of GST credit and Blocked Credits under Section 175 Section 171 to Section 174 deals with when Input tax credit can be claimed while ineligible or blocked credits under GST are dealt with under Section 175 of the CGST act. 1 Where the goods or services or both are used by the registered perso n partly for the purpose of any business and partly for other purposes the amount of credit shall be restricted to so much of the input tax as is attributable to the purposes of his business.

GST is paid on goods services or a combination of the two acquired under the composition system Section 10 of the CGST Act 2017. Under the GST category businesses are allowed to claim GST. Rs18000 is deducted from the GST to be given to the Govt.

Ineligibleblocked credit under GST. 7All GST returns prescribed under the act needs to be filed. The balance amount ie.

For a taxpayer it is essential to determine whether the tax paid on the inward supplies is eligible as Input Tax Credit ITC or shall fall within the ambit of ineligible ITC. 6Supporting documents debit note tax invoice supplementary invoice are needed to claim the Input Tax Credit. I of Section 17 is practically redundant.

Input tax will include any flat rate addition which an approved person under a flat rate scheme would include in the consideration for any taxable supply of goods made by him in a prescribed activity under the scheme.

What Is Blocked Credit As Per Section 17 5 Input Tax Credit In Gst

Gst Input Tax Credit Definitions And Conditions For Claiming Gst Itc

A Complete Guide To Input Tax Credit Itc Under Gst

Input Tax Credit Tax Credits Business Rules Reverse

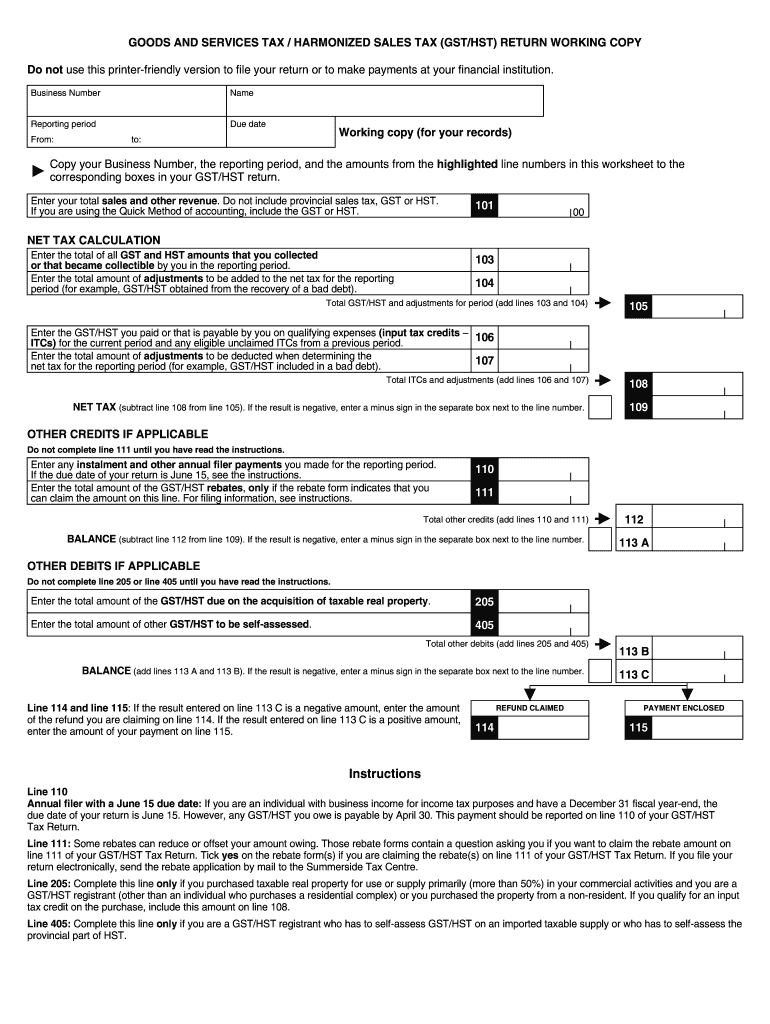

Tax Gst Return Fill Online Printable Fillable Blank Pdffiller

Practical Faqs On Input Tax Credit Under Gst Taxmann

Input Tax Credit Under Gst Goods And Service Tax Simple Tax India

Input Tax Credit Under Gst How To Claim Calculation Method

Input Tax Credit How To Claim Itc Itc Under Gst

What Are The Components Of Gst Quickbooks

Gst On Job Work For Wearing Apparels Textile Manufacturing Http Taxguru In Goods And Service Tax Gst Job Work Wearing Job Work Job Goods And Service Tax

Gst Input Tax Credit Blocked Credits Taxmann

17 Faqs Related To Gst On Handicrafts Http Taxguru In Goods And Service Tax 17 Faqs Related To Gst On H Handicraft Goods And Services Goods And Service Tax

Gst Remittance Form Fill Online Printable Fillable Blank Pdffiller

Know About Gst Input Tax Credit With Illustrations Taxmann Blog

How To Account For Ineligible Itc Under Gst Tallyhelp

3 Gst Hst Areas To Navigate When Constructing Multi Unit Residential Buildings Real Estate Investor Blog Your Real Estate Accountant

.png.aspx)

If You Are A Medical Practitioner Are You Required To Be Registered For Gst Hst And Qst Bdo Canada

Overview On Input Tax Credit Under Gst Law Passed On 27th March 2017 Http Taxguru In Goods And Service Tax Tax Credits Goods And Service Tax Corporate Law